The United States has finalized new “reciprocal tariffs” on various countries, with rates ranging from 10% to 41%. How should this be interpreted? What will be the impact on global trade?

An opinion many Chinese netizens agree on

This move doesn’t usher the world into a new equilibrium, but rather into a new era of chaos.

This isn’t an ordinary tariff adjustment; it’s a brazen restructuring of trade rules, treating free trade as scrap paper and shattering the decades-old WTO consultation mechanism in one stroke.

How broad is the scope of these tariffs? It covers almost all major exporting countries.

The highest rate of 41% targets Syria; Myanmar and Laos get 40%; Switzerland 39%; Algeria 30%; India 25%; Vietnam 20%; Philippines, Thailand, Cambodia 19%; Malaysia and Pakistan also 19%.

The EU, Japan, South Korea, Turkey, and Israel are uniformly set at 15%.

Canada, previously at 25%, is now raised to 35%.

The UK and Brazil fare relatively better for now at 10%, but who knows if the next wave will hit them.

Countries not listed are uniformly taxed at 10%, non-negotiable.

There’s an even harsher measure: the “transshipment tax”.

This means that if your country’s goods are rerouted through a third party to enter the US, or even if they merely transit there, they will be deemed “tariff-dodging” and slapped with an additional 40% transshipment tax.

This is a double blow: not only does it slash at exporting countries, but it also disrupts entire logistics chains.

Even if a ship travels directly between China and the US, you can’t even reroute via Vietnam. The US has effectively implemented a system of “product tracing + trade control + logistics blockade,” tightening the screws on global supply chains.

On the surface, this might look like Trump grandstanding, but in reality, it’s a systematic restructuring.

The White House justifies it as “reciprocal,” claiming other countries impose high tariffs on US goods so the US must respond in kind. The reality, however, is that this wave of tariffs isn’t based on “what tariff you charged me,” but rather “what tariff I want to charge you.”

Some countries, like Switzerland, which had no major trade disputes with the US, are dragged in anyway. This isn’t “reciprocal”; it’s “charge less if you’re useful to me, charge more if you’re not.”

Impact on the US:

In theory, trade wars aim to “bring manufacturing back” and protect American jobs.

But after years of this, little manufacturing has returned, while prices have soared.

This tariff hike will first hit US consumers. From clothing and shoes to home appliances, from agricultural products to auto parts, many rely on imports.

Tariffs increase import costs, pushing up retail prices – ultimately paid by consumers, especially low and middle-income groups already struggling. Adding inflation will sharply increase their living pressures.

Remember, US inflation isn’t fully under control yet, and interest rates remain high. Businesses face expensive loans, and people struggle with debt repayments. Pushing up prices now is like adding fuel to the fire.

Moreover, many small businesses rely on overseas supply chains. If raw materials become unavailable or more expensive, profits shrink, orders disappear, and they may soon fold.

US agriculture is another major casualty.

US agricultural exports rely on a global market; China, the EU, Japan, Canada, and Southeast Asia are key customers. Taxing them will invite retaliation – restrictions or shifting orders. Once popular exports like beef, soybeans, and corn could suddenly lose markets. States in the Midwest dependent on farm exports, where voters are already shaky, could see real defections.

Impact on Targeted Countries:

The situation is more complex for the taxed countries.

Take Canada, one of the US’s most important trading partners, with deeply intertwined supply chains. A 35% tariff shreds the facade of North American “free trade” cooperation. Canada’s main exports to the US are cars, lumber, oil, and aluminum products. Price hikes on these will hurt the US too, but Canadian businesses will suffer most. Reliant on stable US exports, they face fewer orders, excess inventory, vanished profits, and potential layoffs or closures.

South Korea seemingly “succeeded” in negotiating a 15% rate, but the cost is committing to invest $350 billion in the US and buy $100 billion in liquefied natural gas over the coming years. In other words, the US granted a “tariff reprieve” in exchange for “protection money.” The US also hinted at demands for “preferential treatment” in semiconductors, pharmaceuticals, and autos, forcing Korea to agree. Crucially, Korea had little leverage; its negotiating team was summoned to Washington with little preparation, making the process highly passive.

Vietnam is a prime example.

Benefiting from the US-China trade war, Vietnam saw export orders surge, becoming a Southeast Asian manufacturing hub. But the 20% rate targets its manufacturing sector. Garment, shoe, and small appliance factories, with half their orders dependent on the US market, are already considering layoffs, production cuts, or relocating to Indonesia or Bangladesh. Vietnam’s entire manufacturing development path is being abruptly severed.

The Philippines, Thailand, and Cambodia face a similar blow. Relying on US exports for growth, the tariffs make goods harder to sell, cause currency volatility, destabilize capital markets, reduce foreign investment, and create immediate employment problems.

Switzerland is the most aggrieved, inexplicably hit with 39%. The only possible explanation is “making an example” to warn Europe: “Defy me, and I’ll strike.”

EU countries are uniformly set at 15%. If their current tariff on US goods is below 15%, it’s raised to 15%; if it’s above 15%, it stays. This approach squeezes smaller countries while accommodating larger ones, arbitrarily adjusting trade principles as tools. The US logic isn’t rules-based; it’s about posture: “If you want to trade, you play by my rules.”

Broader Global Consequences:

The bigger problem is the chain reaction this sets off.

Countries see that WTO rules are paper tigers; if the US ignores them, why should anyone else?

Nations start formulating countermeasures: some seek new markets (e.g., the EU turning to South America, Africa, and ASEAN); others accelerate regional free trade agreements (e.g., RCEP and China-ASEAN FTA speeding up); others retaliate directly (“You tax me, I tax you”).

This isn’t ordinary trade friction; it’s global trade fragmentation.

Supply chains will reorganize, orders will be redistributed, industries may be forced to relocate, and foreign investment flows will shift.

The era of “global collaboration, efficient division of labor” is being replaced by “self-preservation, short supply chains.”

Everyone is hedging risks, looking for Plan B. If this persists for two years, globalization ceases to be the main theme, becoming an outdated concept instead.

This isn’t alarmism.

Global supply chains have already been decentralizing over the past three years – partly due to the pandemic, partly due to US-China decoupling. This “reciprocal tariff” policy accelerates that trend dramatically. It’s not a one-off event; it’s a directional turning point.

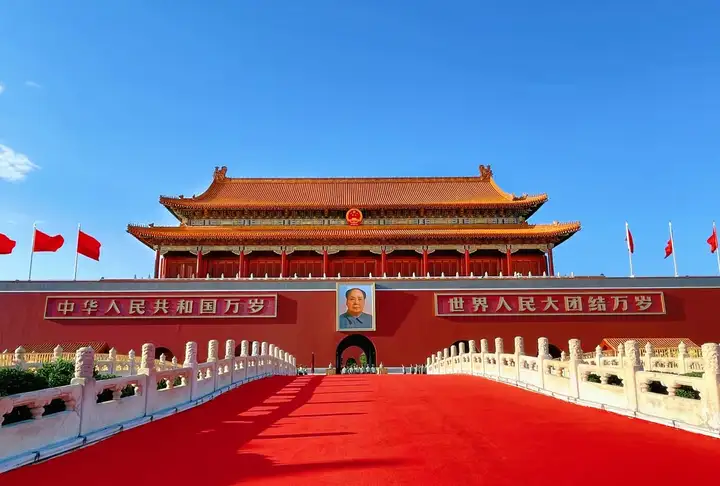

Implications for China:

While not directly named this time, China is inevitably affected. On one hand, the US demands strict “country-of-origin verification,” explicitly banning the transshipment of Chinese goods via Vietnam. On the other, the US is courting Japan, Korea, and Southeast Asia to build a “non-China supply chain.” The real goal is to marginalize China and rebuild a supply hub centered on the US, Japan, and Korea.

But here’s the problem: China’s scale is too vast; many global manufacturing links cannot bypass China. Trump’s attempt to forcibly decouple may well backfire. Other countries can’t replace China quickly, and supply disruptions may eventually lead back to China. Moreover, China is also adjusting its strategy: accelerating import substitution, strengthening R&D, boosting domestic demand, and courting Global South countries. This contest won’t be one-sided.

Conclusion:

This “reciprocal tariff” policy isn’t ordinary trade friction. It’s a signal – the US formally abandoning the “free trade” narrative and pivoting towards “my way or the highway” trade hegemony.

It discards the mask of negotiation, brandishes a big stick, and tells the world: “Trade is my tool; you must obey.”

The problem is: obedience doesn’t foster cooperation; coercion doesn’t earn trust. A trade system without trust cannot be built or sustained.

If everyone fears you, the result is that everyone distances themselves from you.

The world was never built through intimidation; it was built through cooperation.

Anyone who tears down the bridges of cooperation ends up sitting alone on the chopping block, watching others rebuild bridges in another direction.

Globalization might not be a perfect system, but it is the path of lowest cost and highest efficiency. Now, by blocking this highway, you force the world to build new roads through mountains.

Therefore, this move doesn’t bring order; it creates chaos. It doesn’t establish rules; it shatters them. The world descends into turmoil, but the pain may ultimately be felt most acutely by the US itself.

I tried out TP88vn a little while ago. The website is modern looking, games are good. Overall, nothing too crazy, but it’s reliable and fun. Check ’em out: tp88vn

Victory Slot? Cara, gotta love the name! Been spinning the reels and having some fun. Nothing crazy yet, but the vibe is good. Definitely checking it out some more. Who knows, maybe I’ll hit that jackpot! Check them out here: victory slot