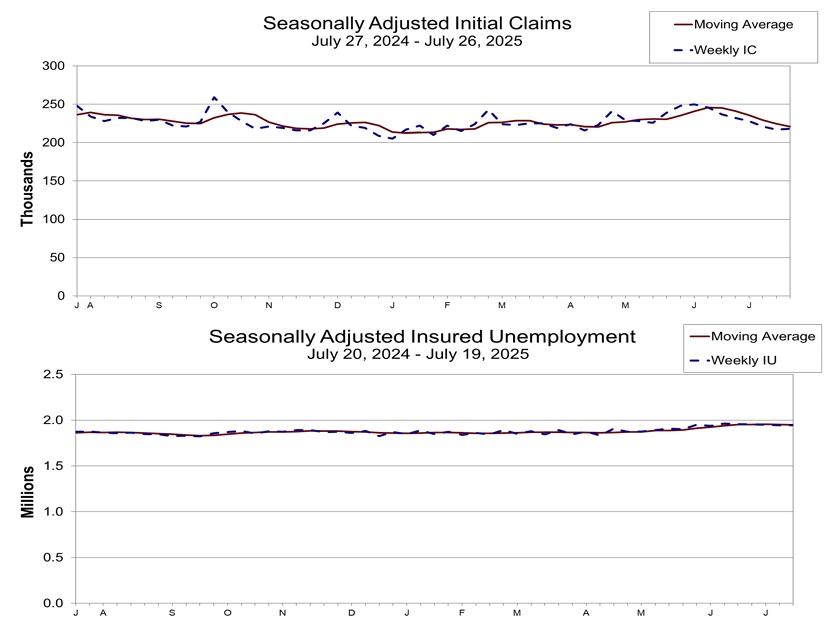

U.S. July inflation, employment, layoffs, and initial jobless claims data all fell short of expectations

Comment 1:

The US is cutting interest rates now primarily out of fear on two fronts. First, capital outflows from the US to China. Chinese stocks and assets are still at low points, and despite economic problems, China is the world’s most stable market. A rate cut now could easily send capital flooding into China. The US rate hikes in 2022 caused a rapid decline in foreign investment into China. Some blamed pandemic lockdowns, but the Fed’s rate hikes were the biggest factor. China’s most dramatic surge in foreign capital happened in June 2022, jumping $24.6 billion in one month – while Shanghai was still under lockdown. The US started hiking in March, but only reached a 1% rate by May. Then the Fed went full throttle, hiking 0.75% at each meeting starting June 15th, quickly reaching 4% by November. By December, China’s foreign investment had dropped to $10 billion. China’s first year-on-year decrease in foreign investment in recent times was April 2023. Yes, even with the huge 2022 inflows, foreign investment still increased in the first three months of 2023. By March, the Fed had hiked to 5%. Then in July, they reached 5.5%, and China’s foreign investment data plunged again in August. From April 2023 until now, guess which month saw the highest foreign investment? October 2024 – yes, the second month after the Fed announced a rate cut. When no cut came in October, November didn’t see sustained increases. But after the Fed cut in November, foreign capital inflows surged again in December. The trend is clear: foreign capital inflows closely track the Fed’s rate hike cycle. If you create a sustained expectation of rate cuts, capital gushes out uncontrollably. The only way to stop it before cutting is to crash the Chinese economy or let the RMB appreciate sharply. But while China’s economy is struggling, it won’t crash, and RMB appreciation isn’t being allowed. So cutting rates now is awkward. That’s why there was recent media promotion of investing in Japan – hoping to divert capital there so if cuts happen, the “water flows to Japan’s field, not China’s.” But Trump is unexpectedly “harvesting Japan” already, not playing by the script. The other problem rate cuts cause is inflation. Sure, the latest inflation data looks okay, core is 2.9/2.8%, but look at the base! US retail sales minus inflation – what’s left? Almost below 1%! On Zhihu, those focused on domestic demand and consumption would say this data is disastrous. It directly reflects that under current inflation, US consumer spending power is on the verge of shrinking. If you cut rates now and inflation reignites, what happens to the world’s largest consumer market?

Comment 2:

This is just performative rage. The government, not the central bank, is the key institution coordinating production. The US government has ample power to regulate employment in any sector purely through administrative means – the methods are “too numerous to list” (subsidies, government procurement, tax adjustments, tweaking credit score-to-rate relationships (LLPA), changing bankruptcy rules, setting credit default exemptions, adjusting sector-specific capital requirements, risk weights, compliance standards, scrutiny levels or efficiency, etc., etc. New tricks emerge constantly, far more intricate than stereotypes suggest). Government policy can finely tune sector efficiency – recent examples are the CHIPS Act, Inflation Reduction Act, Infrastructure Investment Act, and the “Brilliant” or “Smart” Acts. Compared to the blunt, laggy, and uncontrollably side-effect-ridden tool of rate hikes/cuts, industrial policy can be incredibly precise and take immediate effect. It can even offer case-specific guidance to individual companies, offering high flexibility. The Fed moving rates impacts capital markets fastest and hardest; the effect only spreads to consumer/investment markets after capital markets fully digest it. A 1% change is massive for capital markets but less significant for the real consumer market. The federal government is a very powerful institution, and Trump especially has shown us that. Yet now, raging at the Fed Chair over slightly disappointing numbers? It’s likely about finding a scapegoat for potential future inflation waves. Also, both Trump and the US economy might need a timely, sharp recession to reset.

Comment 3:

Everyone was talking about US debt defaulting in June… turns out it really did “default,” but they faked their way past it temporarily.

Comment 4:

Saying the data “missed expectations” is putting it mildly. The market’s reaction is: “My previous understanding of the US economy was completely wrong!!” Because US data was historically very transparent and credible, markets priced assets based on it – a core logic of capitalist markets. Timely, reliable data allows markets to adjust. This was touted as the core advantage over planned economies, where a committee of thousands of bureaucrats could never match the speed and accuracy of capital markets. Capital markets also have survival of the fittest: capital making accurate predictions/pricing thrives, while inaccurate players lose and vanish – an evolutionary advantage. Planned economies, in contrast, ossify due to bureaucracy. But both systems rely fundamentally on statistical data for pricing and adjustment. If the data is fake, it’s like building a castle on sand – height doesn’t matter. US capital markets now face this problem. Dealing with the once-in-a-century populist Trump, who constantly breaks norms, was already a headache, but they could treat him as an unpredictable event. But if the core data is wrong, capital markets lose their compass. The narrative was: the US economy is resilient; Q2 growth was strong (3%); jobs data good; Trump’s tariff chaos seemed manageable as deals were struck country by country; just wait for inflation to stabilize, watch the tariff impact, and the Fed would cut rates. But the revised data changes everything. The US economy seems stuck in stagflation. The “strong economy” was an illusion; Q2 growth came more from falling imports due to the tariff war; employment is collapsing; core inflation won’t drop; and it’s likely to rise again once tariffs fully hit. Economic stagnation plus high inflation? That’s stagflation. So, if the US is truly in stagflation, what next? US stock valuations are sky-high. Repricing under stagflation could mean more than halving. Bond yields? Forget rate cuts, expect more hikes. Stocks, bonds, currency all crashing, with massive capital flight inevitable.

Comment 5:

Releasing this data right when tariffs kick in? This is the Democrats throwing shade at Trump.

Comment 6:

The consequences of the US tariff war on various countries have a lag in the data; it just showed up this month.

Comment 7:

Kudos to the US Census Bureau comrades. If the faked data is this bad, the real data must be worse.

Comment 8:

This is all Powell’s fault. Powell doesn’t support the tax cuts President Trump advocates, preventing US companies from hiring more workers. The Fed under Powell is wildly wasteful, utterly oblivious to the people’s suffering. Across all fifty states, babies are dying, common people are like fish on the chopping block. Does Powell even know?

Other summary opinions:

- On Data Revisions and Market Shock:”The employment data suddenly collapsed, causing an uproar on Wall Street! Friday, the U.S. Bureau of Labor Statistics announced that July non-farm payrolls sharply dropped to 73,000, hitting a 9-month low and far below the expected 104,000. Data for May and June were significantly revised downward… These signals indicate the U.S. labor market is not just moderately cooling but rapidly braking, potentially triggering renewed recession fears.

- On Structural Issues in Data Collection:”After the pandemic, survey response rates for many government statistics have plummeted. For instance, employment data response rates fell from 60% to 40%… Data bias inevitably expands. Willingly responding subjects are often those in better conditions, so monthly surveys exaggerating actual employment data is no surprise.

- On Stagflation Risks:”The U.S. economy is showing signs of ‘stagflation’—employment recession coupled with intensified inflation! Core PCE hit a new high since February, while actual consumer spending grew weakly. High inflation and stagnant incomes are squeezing purchasing power.”

- On Political Pressure and Policy Errors:”The Fed’s insistence on not cutting rates angered Trump, who erupted with profanities. Powell’s term may see no rate cuts or at most one… Trump’s unpredictable tariff strategy has spread uncertainty through the economy, creating caution among businesses.”

- On Questioning Data Authenticity:”If this employment data were about China, it would equate to the Qing Dynasty after the Wuchang Uprising. The job growth mainly came from government hires and healthcare sectors—both relying on fiscal funding. Manufacturing jobs actually shrank.”

- On System Limitations:”The U.S. is a highly data-driven society where timeliness of data release takes priority over accuracy. Quick and stable directional signals matter more than delayed historical precision. This is the logic of modern data-driven governance.

Finally ditched the browser! The PokerBaazi desktop app is smooth as butter and loads faster. Gameplay’s way more immersive now. Check it out yourself: pokerbaazidesktopapp

F12betBR, curto demais essa plataforma! Sempre tem umas promoções boas e as odds são bem interessantes. Já fiz uma fezinha! Confere aqui: f12betbr